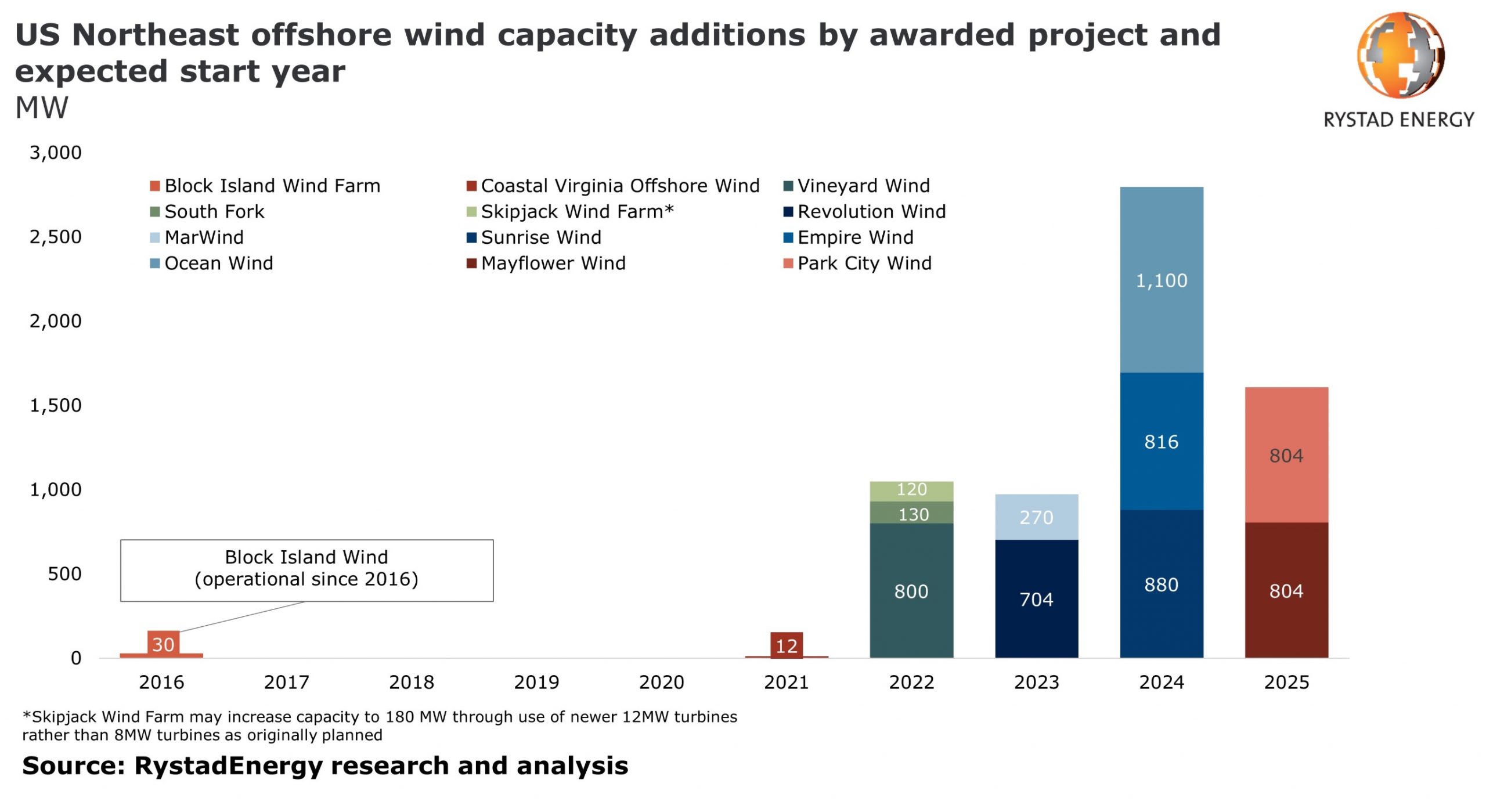

U.S. offshore wind capacity will reach 200 gigawatts by 2030, and annual investment in the sector will exceed $15 billion by the mid-2020s.This would mean that US offshore wind capex could exceed US offshore oil and gas capex over the next five years,writes Rystad Energy.

“There are currently 6 GW of offshore wind projects in the US that have been sanctioned for development, requiring collective investments of more than USD 20 billion over the next five years”, says Tim Bjerkelund, Head of Consulting New York at Rystad Energy.”Assuming continued support from the regulators, many more projects will be sanctioned in the coming years and we expect to see yearly investments in the sector exceed $15 billion by the middle of the decade. That would certainly signal an energy revolution and offshore suppliers should take note.”

By contrast, Rystad Energy expects to spend an average of $14.8 billion a year on offshore US oil and gas projects between 2020 and 2025.

Northeast US

Most offshore wind projects are in the northeastern United States.These states face the same problems as those in north-west Europe;Renewable energy sources can reduce reliance on energy imports, but the region lacks available land to accommodate wind and solar farms.

According to Bjerkelund, these states have “wisely” adopted the same strategy as European countries, moving wind farms offshore and benefiting from the technological development and cost efficiency introduced in the North sea.The costs for major projects like Vineyard Wind are expected to be close to the levels of European projects.Rystad Energy notes that this bodes well for an industry that is still in its infancy.

The potential for offshore wind power in the US is 7,200 terawatt hours (TWh), according to the Energy Information Administration (EIA).If all of this were to be realized, it would equal hundreds of projects similar to the ones already sanctioned, with each requiring investments of around USD 3 billion on average.

“The emergence of offshore wind as an industry in the US is truly exciting. The energy transition is taking place now, not through small test projects, but through utility-scale projects that each require billions of dollars in investment,” Bjerkelund concludes.

US offshore wind projects Rystad Energy scaled